Your workers’ compensation temporary disability payments are generally two-thirds of your average weekly wages. If you earned $900 a week before your injury and are unable to work, you will receive $600 a month in temporary disability benefits, which are tax-free. People sometimes don’t undertand what to do when your injured on the job. Please give us a call.

Schedule An Appointment To Talk To A Workers Compensation Attorney

Hurt at Work? We can help!

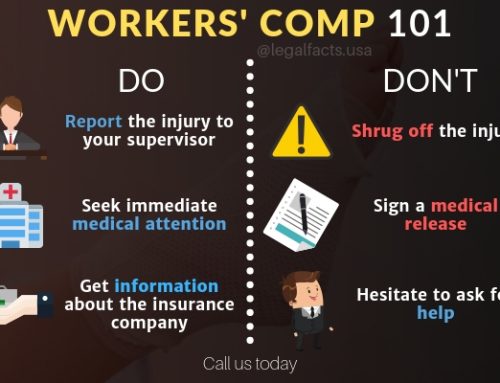

When you suffer an injury at work, you need an experienced workers compensation attorney on your side who knows the law and has experience in dealing with your employer’s insurance company. We have dealt with ALL insurance companies in California and obtained large settlements for our clients. Here are the following steps.

In workers compensation, not every case is this simple. Some circumstances will require a more in-depth look at your earnings and other factors to determine what your earning capacity was or would be if you were not injured. A few factors that could affect your payment amounts include:

REAL WORLD RESULTS

“I’ve received $400,000.00 through a Compromise and Release in addition to Medical Treatment for Life!”

-Mr. Rojas

“My insurance company wanted to close the case without the possibility of future medical treatment. LG LAW allowed me to continue seeking necessary medical treatment paid by the insurance company.”

– Mr. Avalos

Why Us

1 888-901-5240

Don’t Let the Insurance Companies Intimidate You

In these situations, it can be more complicated to determine what your average weekly earnings are.

For example, if you were set to receive a wage increase in three months, but suffered from a job-related injury before receiving the raise, should this amount be included in your average weekly wages? Of course, this would typically only be relevant in situations where your wage increase had already been agreed to in advance, such as when a union pay scale is in place.

This calculation is also more difficult when the employee does not work a regular schedule, or if work is paid based on piecework or commission. California law also states that for employees that work less than 30 hours a week, the average weekly earnings should be determined based on what the employee’s reasonable earning capacity at the time of injury. This means that consideration is given not only to what an employee has earned, but also to what their post-injury earnings would be. Go to https://lglawoffices.com/workers-compensation/work-restrictions-injury/ to find out what are the work restrictions.

Furthermore, there are statutory minimum and maximum amounts that you can receive in workers’ compensation temporary disability benefits. If your income was above a certain amount, you will receive the statutory maximum in benefits, which may be less than two-thirds of your wages. If your income was below the statutory threshold, you will receive the minimum amount, which could be more than two-thirds of your wages. You can also receive partial temporary disability benefits in some cases, if you return to work but your wages are less than the limit set by California law.

If you have questions about your average weekly earnings and how they affect your workers’ compensation disability benefits, talk to a workers’ compensation attorney.

LG LAW – Workers Compensation, Bankruptcy & Personal Injury Law Firm have been helping injured California workers get the benefits they deserve since 1999. Click here to get direction to our Ontario office. To schedule your free consultation, call us at 1 888-901-5240 today.